OVERVIEW

According to analysis by GlobalData, government budget squeezes are expected to reduce public sector spending on infrastructure in the short-term with a consequent effective on many types of projects, including underground. The budgeted buck buys less, too, in general as costs – material and financing – rise. Geopolitical conflicts also add to investment uncertainty.

But GlobalData points to less difficulty in some areas with long-term strategic push backing infrastructure spend, such as China, the US and India.

Within the infrastructure world the dominant sector for investment in transport, primarily rail and metro, with highways and roads a not too distant follow-on, depending on country and regional mixes.

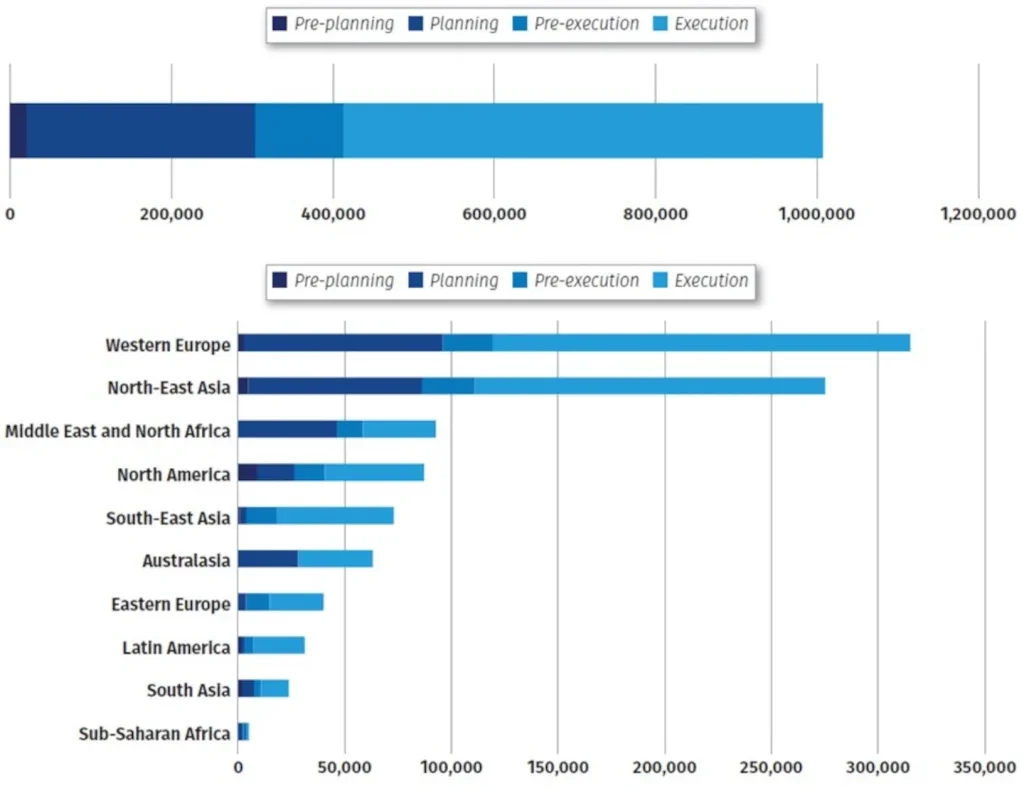

In its latest, thirst quarter (Q3) analysis, GlobalData’s tracked data says the pipeline of tunnel projects worldwide – which is construction containing some shares of underground works – is approximately US$1 trillion. Projects counted in the global pipeline range from those in early planning or design to others in procurement or construction. More than half of the project tally is for tunnel-related projects already in construction.

Regionally, and measured in total distance being built, most of the projects (involving tunnels as well as surface sections) are in Western Europe, Middle East and North Africa (MENA), and North America. Together these three large regions account for approximately two-thirds of the total distance.

In terms of funding, by far the majority of the global total – about 81% – are publicly funded. This weighting in the funding mode holds up in each region, ranging from about 60% to 90% of their pipeline investments, all measured in US$.

The public/private funding mode is present throughout, although in decidedly minor ranking, except for holding its largest share in Latin America (25%).

Private mode funding is not used everywhere, and has typically a small stake where it is employed (minor single digit percentages) – again except for Latin America (16%).

Most (91%) of the total investment concerns tunnelrelated projects in the transport sector. Road & metro spend is proportionately larger than highways & roads to a ratio of approximately 3:1. Even so, globally, according to the analysis, the highways & roads projects involving some underground works total about US$230 billion.

EUROPE

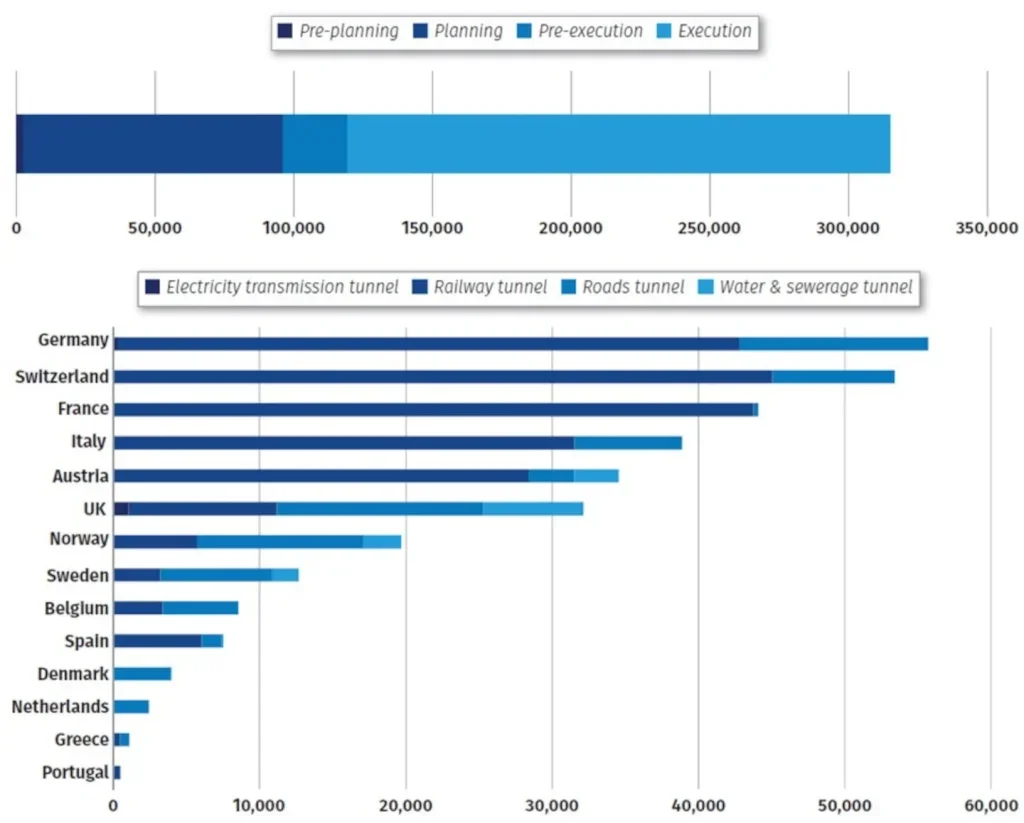

Western Europe

The total tunnel-related construction pipeline in Western Europe is about US$315 billion. The region comprises – ranked in decreasing order of total tunnelrelated project pipeline value – Germany, Switzerland, France, Italy, Austria, UK, Norway, Sweden, Belgium and Spain.

The majority of the project pipeline is publicly funded (73%), then public/private (14%) and private (13%).

Most of the total pipeline activity (about 70%) of tunnel-related infrastructure projects is for those in the pre-execution and execution phases of development, the latter being the larger.

Road projects in the region hold, in terms of pipeline value – at almost US$79 billion, combined – the smaller share of the total transport sector activity. Rail & metro is almost three times as large, by value.

By nation, the tunnels-related roads projects are led by the UK, Germany and Norway, followed by Sweden, Switzerland and Italy.

However, roads is only the larger pipeline value in the transport sector in the UK, Norway and Belgium. Transport investment in the other European nations is dominated, by far, by rail & metro project pipelines – in descending order being Switzerland, France, Germany, Italy and Austria, and then some way behind, the UK, Spain, Norway, Sweden and Belgium.

Among the UK’s road projects in the tracked data are, as would be anticipated, two major investments in the London region – the planned Lower Thames Crossing and the currently in-construction Silvertown Tunnel.

Eastern Europe

The total tunnel-related construction pipeline in Eastern Europe is about US$40 billion.

The region comprises – ranked in decreasing order of total tunnel-related project pipeline value – Romania, Turkey and Poland, primarily, but also listed – continuing the order, in a wide catchment, are Kazakhstan, Bosnia & Herzegovina, Ukraine, Bulgaria, Czechia, Slovenia and Georgia.

The majority of the project pipeline is publicly funded (80%), then public/private (19%) and private (1%).

Most of the total pipeline activity for the tunnelrelated projects are for investments in already in construction.

Roads tunnel projects feature only in a very minor way in the region, according to the analysis. What roads tunnels activity there is takes place, primarily, in Bosnia & Herzegovina, Bulgaria, Georgia, and then Turkey. Again, the rail & metro value pipeline dominates, especially in Romania, Turkey and Poland.

Interestingly, Kazakhstan stands out for its tunnels related to resource and energy extraction industries – mining (copper, uranium) and oil & gas, respectively.

AMERICAS

North America

The total tunnel-related construction pipeline in North America is about US$87 billion. The region comprises the US and Canada, the former value being proportionately larger than the latter by a ratio of 4:1.

However, despite the difference in scale nationally, the large scale of water & sewerage tunnel projects in the US takes up much of the share of value, proportionately far more than in Canada. This results in the total value of tunnel-related transport projects in the US being only 3:1 larger than in Canada.

But when it comes to tunnel-related projects for highways & roads, in absolute financial terms the picture flips – Canada has more than the US, at about US$9 billion versus US$7 billion, respectively. Their combined total is more than US$16 billion. In fact, in Canada, road projects dominate all sector activity. In the US, by far the most tunnel-related transport projects is in rail & metro, edging out water & Sewerage.

By far the majority of the project pipeline is publicly funded (97%), then private (2%) and public/private (1%).

Latin America

The total tunnel-related construction pipeline in Latin America is about US$31 billion. The region mostly comprises – ranked in decreasing order of total tunnelrelated project pipeline value – Colombia, Chile, Mexico, Brazil, Argentina and Peru.

Most of the total pipeline activity (about 90%) of tunnel-related infrastructure projects is for those in the pre-execution and execution phases of development, the latter being the larger.

In terms of value, road projects only have a minor share of the total, at almost US$4 billion. Most of the roads projects activity is in Chile and Peru with small amounts in Colombia and Brazil. By far, the regional value pipeline is dominated by rail and metro investment in the major cities.

The project pipeline is dominated in this region by public/private funding (59%), followed by public (25%), then private (16%).

ASIA

Northeast Asia

The total tunnel-related construction pipeline in Northeast Asia is about US$275 billion. The region comprises – ranked in decreasing order of total tunnelrelated project pipeline value – China and Japan, and these value pipelines far outweigh those of South Korea and Hong Kong by orders of magnitude.

About two-thirds of the total pipeline activity of tunnel-related infrastructure projects in the region is pre-execution and execution phases of development, in total. As they dominate the figures, this echoes the balance of activity stages in the two main countries.

Across the region there is a total of almost US$72 billion in pipeline value related to roads tunnel projects. Most relate to China, taking up about one-third of its infrastructure pipeline investment activities concerning tunnels in some measure; the rest of the spend in China relates to rail & metro, in the figures. In Japan, road tunnel-related spend is less than a tenth of its national pipeline of underground infrastructure.

Most of the projects are publicly funded mode (89%) and public/private (11%).

Southeast Asia

The total tunnel-related construction pipeline in Southeast Asia is about US$73 billion. The region comprises – ranked in decreasing order of total tunnelrelated project pipeline value – Singapore by an order of multiples, and then Malaysia, Thailand, Indonesia and Vietnam.

Regionally, the largest share of activity stage for the projects is pre-execution and execution, and this is reflected in the largest activity nations – Singapore and Malaysia. Pre-planning and/or planning only feature, and in small ways, for data listed for Indonesia and Thailand. More stages of Singapore metro are to come but weren’t showing in the categories.

In terms of tunnel-related road projects, the principal activities are also in Singapore with Indonesia, Vietnam and Thailand some way behind. In total, the roads tunnels pipeline is US$10 billion, about three-quarters taken by Singapore.

Like for northeast Asia, the GlobalData analysis puts the funding modes at majority public (89%) and public/ private (11%).

South Asia

The total tunnel-related construction pipeline in South Asia is about US$24 billion. The region comprises – ranked in decreasing order of total tunnel-related project pipeline value – India, being larger by multiples over the following main nations spending which are Nepal and Pakistan.

About one-third of the total pipeline activity of tunnel-related infrastructure projects in the region is pre-planning and planning stages of development, in total; the majority in pre-execution and execution phases.

The pre-planning and planning stages of development have a bigger share of activity stage in the largest country investing – India; the other nations, while their overall investment pipelines are much smaller those activity stages are weighted toward execution.

Tunnel-related road projects feature heavily in the investment in this entire region – particularly so in India but also in Nepal and Bangladesh. The pipeline in India is almost US$14 billion – more than half of all tunnelrelated activities in the entire region.

Most of the projects are publicly funded (87%), then public/private (12%) and private (1%).

AUSTRALASIA

The total tunnel-related construction pipeline in Australasia is about US$63 billion. The region comprises New Zealand and Australia, the latter value being about 70% of the former. In fact, what New Zealand has in pre- planning and planning – and is its majority activities, by stage – is more than the entirety of the tracked listing for Australia, dominated by works underway on site.

Overall, therefore, the region has pre-execution and execution stage activities that slightly outweigh those in pre-planning and planning.

Rail & metro are by far the majority sub-sector investments in both countries. Little is happening, relatively, in either tunnels-related roads projects in either nation, being only slightly more in Australia, at approximately US$4 billion. In total, such roads project investment has a pipeline value across both countries of less than US$7 billion, and rail & metro is more than eight times bigger.

In funding, most projects are publicly funded (86%), the balance (14%) is by public/private mode.

MIDDLE EAST, NORTH AFRICA

The total tunnel-related construction pipeline in MENA is about US$93 billion. The region comprises – ranked in decreasing order of total tunnel-related project pipeline value – Israel and Iran by a long way, and then UAE, Saudi Arabia, Qatar and Algeria, the others listed (Kuwait, Oman, Iraq, Egypt) each having about US$2 billion or less.

Most of the projects are publicly funded (74%), then public/private (23%) and private (3%).

For the region, the total pipeline activity of tunnelrelated infrastructure projects is split fairly evenly between planning and construction phases, and almost all the former is in Israel, the latter in Iran mainly, along with Qatar, Saudi Arabia, Algeria and UAE.

Across the region, tunnel-related roads projects have the smallest share of the investment pipeline, at almost US$8 billion – two-thirds of which is in Iran.

Most pipeline activity in the region is though, once again, dominated by rail & metro projects. The subsector of transport constitutes almost all of the pipeline in Israel, and about-three-quarters of tunnels investment in Iran, according to the data.

Non-transport dominance of tunnels-related projects is a position held only by water & sewerage investment in the region, and this is notable for UAE, Qatar and Saudi Arabia.