Like a home-owner with a well worn to-do list, MTA Capital Construction, the agency charged with building New York’s transportation infrastructure, should be crossing off a major item come June 2014 with a solid sense of satisfaction. As one of three tunnel mega-projects currently underway in New York, the USD 2.4bn 7 Line extension is on schedule to open that month for revenue service.

Tunnelling, among other underground construction, is still ongoing on the East Side Access (ESA) project, and the Second Avenue Subway (SAS) is making progress on its stations. The ESA is scheduled to complete in 2019, delayed from original plans. And the Second Avenue project comprises only phase one of four, with no funding in place for the final three legs. With these subway projects wrapping up, while transit and water projects in California are popping up, the industry is seeing a shift of work from east to west.

In his speech at the TAC conference in Montreal last October, Jeff Petersen of Kiewit, mentions this in his remarks about the US market for tunnelling. "I’m sure those that have been around for a while are no stranger to this cycle," he says. Later adding, "Granted, there are significant tunnel programs and projects on both coasts and in the middle of the US."

He questions if a shift in the volume of work to the west really exists, or if it is just a perception. What is clear is that funding is available in the west to support new projects. Both Seattle and Los Angeles voters passed measures in 2008 to finance public transit development.

New York

A report released in March by New York’s comptroller Thomas DiNapoli highlights delays and cost overruns on the ESA project. The MTA’s initial estimate of USD 4.3bn has grown to USD 8.25bn, with completion pushed back 10 years, from 2009 to 2019. "The MTA’s official cost estimate, however, excludes the full cost of passenger railcars associated with the project, which raises the cost of the project to USD 8.76bn," he points out in the report.

In response to a draft copy of the state comptroller’s report, the MTA explains that its initial 1999 estimate was based on conceptual plans and that there was virtually no engineering behind the estimate. According to the MTA, it was not until 2006 that the design of the project was sufficiently advanced so that reasonable budgets and schedules could be developed. The MTA also says the increased costs and delays since its 2006 estimate could be explained by a number of factors, including overly aggressive schedules; the number of large infrastructure projects in New York City and elsewhere, which reduced competitiveness; a contractor that performed poor quality work and subsequently defaulted; unforeseen construction challenges; cost escalation due to longer project duration; and, more recently, an Amtrak rehabilitation project of the East River tunnels.

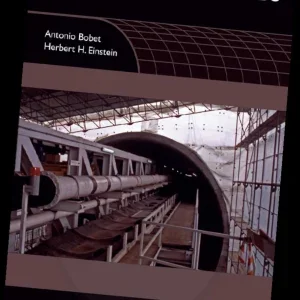

Construction for the SAS, which will connect 125th Street to the Financial District along Second Avenue, is planned in four phases. Phase One has seen dual tunnels excavated between 92nd and 63rd Streets, and three new underground stations. TBM mining completed in September 2011 for a total of 7,789ft (2.37km) of tunnels by S3, a joint venture of Skanska, Schiavone and Shea.

As of this spring, mining crews at the 86th Street Station have broken through south to north in the upper section of the station cavern excavation, creating a continuous open underground space from 83rd Street to 86th Street. A contractor joint venture of Skanska/Traylor secured the USD 322M contract for the station in August 2011, and is forecasted to complete the work in September 2014. Drill and blast activity continues through the spring to excavate parts of both the northern and southern caverns.

On March 21, MTA announced that all blasting for the 72nd Street station structures is completed. The contractor, SSK Constructors (a joint venture of Schiavone, Shea and Kiewit) will continue to waterproof and install the steel reinforced concrete lining of the underground station cavern and tunnels. SKK started drill and blast work in January 2011 and excavated and removed a total of 183,000 cu.yd (140,000cu.m) of rock. The follow-on finishes contract, which will complete the mezzanine and platforms, station entrances, ancillary buildings and the mechanical, electrical and plumbing systems for the station was awarded to Judlau Contracting on February 14.

While the project makes good progress on Phase One, there is no word on how or when future phases could be funded. MTA’s next capital program, which is schedule to start in 2015 through 2019, is not yet announced.

In October 2012, the state comptroller also released estimates that the MTA could require at least USD 20bn over five years to fund its core capital program, which provides for "a state of good repair, normal replacement and system improvements." Additional resources would be needed to begin the next phase of the Second Avenue Subway and other expansion projects.

The bottom line

Looking beyond Manhattan and its neighbouring boroughs, further a field in the state of New York is the Delaware Aqueduct bypass tunnel project, estimated to cost USD 1.2bn. Heading south, the nation’s capital is starting work on a major tunnel project, the first of four for its Clean Water program, which carries a USD 2.6bn price tag.

Hartford, Connecticut, and the Narragansett Bay Commission in Rhode Island, are two of many cities and municipalities working to eliminate CSOs. These programs often include underground construction for shafts, microtunnelling for smaller diameter sewers and often large diameter tunnels. The Metropolitan District in Hartford will spend an estimated USD 1.6bn on its CSO program, which includes the South Storage Tunnel some 28ft (8.5m) in diameter, three-miles (4.8km) long with construction possibly starting in 2014.

Meanwhile, planned transit lines for Boston and Baltimore that would likely require tunnel construction are stalled, as are a several of highway tunnel projects on the east coast. With funding secured, all of this is easily worth tens of billions in contracts for the industry.

On the west coast there are billions of dollars being spent on tunnels in Seattle for the Alaskan Way Viaduct replacement and light rail extension projects, several of which have yet to bid their construction contracts. San Francisco has projects in various stages of construction — the Central Subway, the Bay Tunnel and the New Irvington Tunnel among others. Those three projects account for more than USD 2bn.

What’s waiting in the pipeline boasts the biggest price tags. The Transbay Transit Center/Caltrain Downtown Extension (TTC/DTX), in downtown San Francisco will include underground construction and has a budget estimated at USD 4.1bn. Though currently funding is lacking for the USD 2.5bn Phase Two.

In Los Angeles, there are tunnels forthcoming for the region’s Metro line with funding lined up through increased taxes. The West Side Subway Extension of the Purple Line will be delivered in three phases, with the first estimated to start construction next year. The total project is forecasted to cost USD 6.3bn. About three-fourths of those funds are generated locally from Measure R, a half-cent sales tax approved by Los Angeles County voters in 2008. Los Angeles County Metropolitan Transportation Authority (Metro) will be seeking the remainder in federal matching funds through the New Starts Program. It is also said to be pursuing alternate funding scenarios that could accelerate subway construction possibly allowing the entire 9-mile (14.5km) project to be built in one phase at a reduced cost and opened as early as 2023.

The Metro Crenshaw/LAZ Transit Corridor Project is an 8.5-mile (13.7km) grade separated expansion with at least six stations, and possibly two more. Portions of the alignment will be mined by TBM. The project budget is approximately USD 1.7bn with the majority of funding coming again from Measure R. The ever-likely possibility of high-speed rail being built in the state adds more opportunities as well.

Then there is California’s proposed Bay Delta Conservation Plan (BDCP), which calls for some 35 miles (56km) of twin tunnels for water conveyance. Governor Brown has proposed 40ft (12.1m) inside diameter tunnels built more than 150ft (45.7m) underground, estimated to coast USD 14bn. A Draft Environmental Impact Statement/Environmental Impact Report will be released later this year for the entire project.

Sandy

New York did see an influx of cash last year, though that is under grim circumstances. In the wake of Hurricane Sandy FEMA issued some USD 2.7M of expedited funds to the MTA for work on two flooded road tunnels.

The Hugh L. Carey (formerly Brooklyn-Battery) and Queens Midtown tunnels were collectively flooded with approximately 72 million gallons of brackish, oily water when Sandy struck October 29, 2012. The dewatering operations started as soon as possible.

"These tunnels were devastated from floor to ceiling, and it is no small feat to try and make these complex and time-consuming repairs while continuing to move an average 119,000 vehicles through them each day," said Tom Prendergast, president of MTA New York City Transit and Interim MTA executive director.