TUNNELLING ACTIVITY

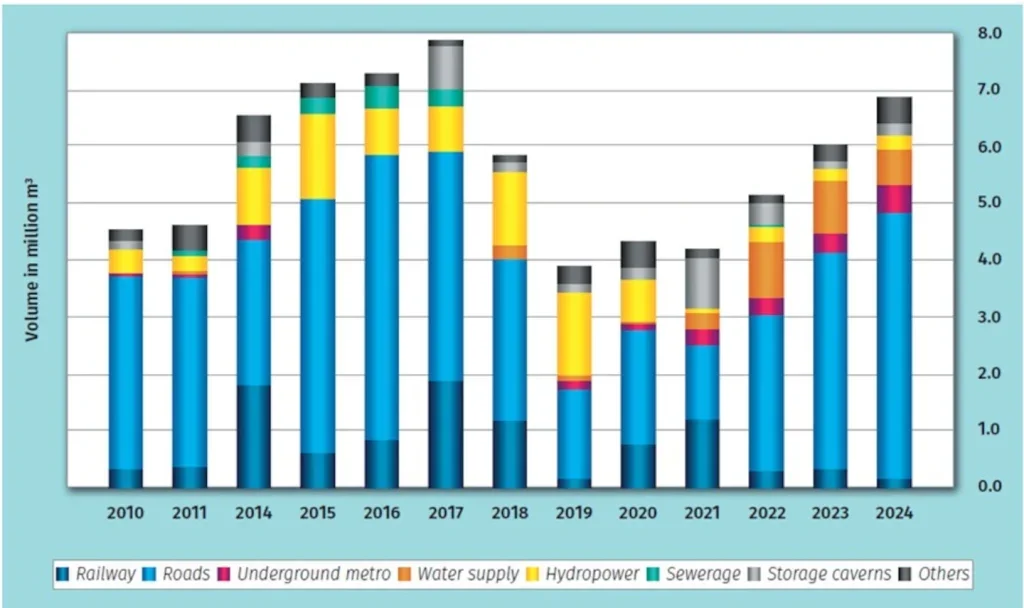

Since 2019-20 the total tunnelling activity in Norway has been on an upward climb almost continuously. The pandemic caused the output only to plateau and then the climb resumed.

Compared to 2021 the level of activity has increased more than 60% to approximate 6.8 million m3 over the period, according to the latest national figures from the Norwegian Tunnelling Society (NFF – Norsk Forening Fjellsprengningsteknikk).

In fact, the level of activity has grown so much since 2021 that over the last 53 years of records there were only three years, and recent ones – 2015-17 – that were greater in overall tunnelling activity. And, two of the said years were only slightly above the total activity reported for 2024, and that leaves the year to beat as 2017 which approached 7.8 million m3.

Drill and blast is the predominate method of tunnelling in the generally hard rock northern country. Some TBM works take place but are very much in a minority position, overall.

The increase in tunnelling activity last year – 841,000 m3 more than the approx 6 million m3 in 2023, or a rise of 14% – was driven by even more activity in the road tunnelling sector. Work on roads tunnels dominates tunnelling in Norway and it has rapidly scaled up over the last few years, after a downturn at the turn of the decade. Before then the level amount of road tunnelling work was also high – the activities in both 2015 and 2016 being on par with 2024.

In total, road tunnel activity was approximately 4.6 million m3, or about two-thirds of the total for last year. The other tunnelling activities that made up the other third of total tunnelling activity last year included excavations for rail & metros, water supply, hydropower, storage caverns and miscellaneous other categories.

Tunnelling for rail has fluctuated markedly over the last nearly 20 years, with peaks in 2013, 2017 and 2021.

Investment in water supply tunnels has increased of late, notably since 2018, with only sporadic spend on such excavations over the prior decades, primarily in the 1990s.

Long famous for its hydropower resources and associated infrastructure, including many tunnels and caverns, the level of tunnelling activity in this energy sector is not what it once was, by a long way. There has been little of late, the last works ending by the pandemic. The heyday of hydropower tunnelling was over the decades up to the late 1980s, when such works took the lion’s share of annual tunnelling activity. Then the balance shifted to dominance by transport tunnels, mostly for roads, as noted.

In terms of total distance of new tunnels, the NFF figures show the trend of the totals following the overall tunnelling activity, telling that linear tunnels markedly dominate the excavation work. Last year almost 100km of new tunnel was constructed – almost double the level of 2021.

CONTRACTORS

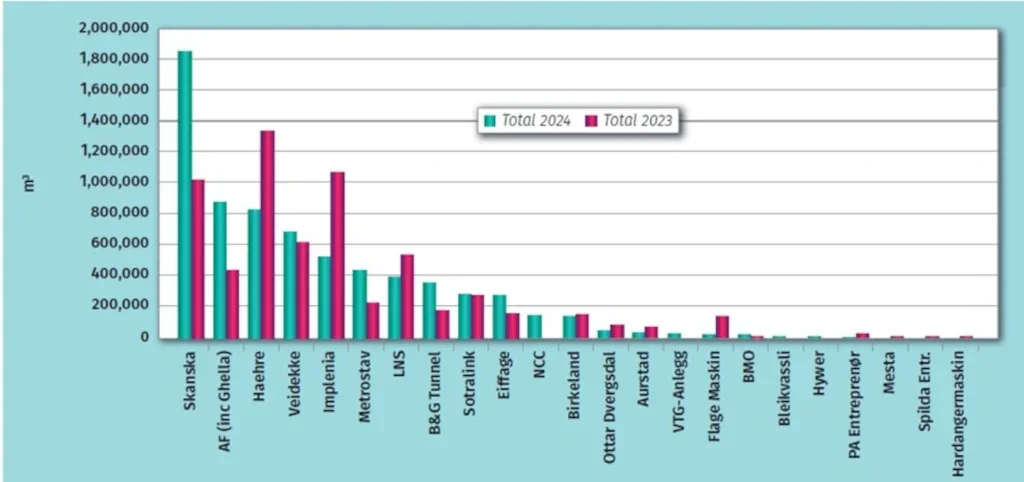

The NFF study says that 2024 was a further year of change at the top of the tunnelling activity table among contractors.

The most active contractors in tunnelling last year were, in order from most active: Skanska, AF (incl Ghella – counting as a JV), Haehre, Veidekke, Implenia, Metrostav, LNS, B&G Tunnel, Sotralink, Eiffage, NCC, Birkeland, and then others.

Skanska was top, moving up from third place in 2023. NFF says the huge jump in activity for the Skanska in 2024 over the prior year was also the highest ever for any company surveyed in Norway on tunnelling activity.

AF/Ghella JV move up from 6th place to second. Its activity level increased over 2023.

Haehre dropped from first place to third, its activity level also dropping.

In 2024, Veidekke maintained fourth place, its activity level nudging up over the previous year.

Implenia went from second place in 2023 to fifth place last year, its activity level dropping in 2024.

Metrostav moved up a place to sixth position.

LNS moved down to seventh place from fifth, in 2023. Its activity level in tunnelling was slightly lower.

While drill and blast is the predominant tunnelling method in Norway. Among the top ranked contractors, during 2024 there were TBMs used by Skanska and the AF/Ghella JV, respectively, says NFF. Skanska was also active with the machines in 2023, it previously noted.

Since 2010 there have been more than 15 contractors active in tunnelling, to some greater or lesser degree, in Norway, according to the NFF figures. Since 2013, except for two years (2014, 2023), the total has been at least 20. The numbers trended up over 2009-2013 and has stayed broadly level since, and recently, even as total tunnelling activity once again closes on highest prior levels.