Compared to wealthier countries, such as the UK and US, the recession and economic woes of the past few years did not have as severe an effect on those in Latin America. Couple that with the need to build much of their infrastructure, and there are plenty of opportunities for tunnelling, but with their own hurdles.

When asked how the financial crisis has affected tunnelling in Mexico, project manager for the District Federal, Enrique Horcasitas says he isn’t so sure there is even a crisis, as there are several EPB machines working in and around Mexico City. “We’ve never had this many. This sounds like a boom.”

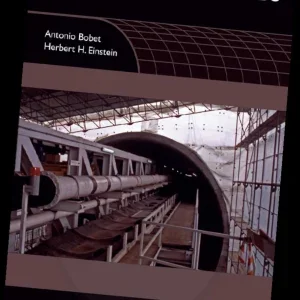

He’s overseeing construction of the city’s Metro Line 12. A 10.2m diameter Robbins EPB machine will bore 7.8km and cross seven underground stations of the 25km alignment. The approximately USD 1.4bn contract awarded to Mexican construction firm Ingenieros Civiles Asociados (ICA), in a consortium with Carso and Alstom, calls for construction to be completed in 2012, when the city’s mayor’s term ends.

It’s the first time in 10 years that Mexico City is doing underground construction for its metro system. While Horcasitas explains the project is partly related to politics—the current city government is pro-tunnels—the topic of climate change has had influence as well, helping gain a positive public perception.

“The tunnels market in Mexico is lower mainly due to the lack of building important infrastructure,” says Horcasitas. However, he points out, “infrastructure development in Mexico seems to be growing.”

There are currently major construction projects, but there are also challenges to overcome in the short term. Besides Line 12, Mexico City’s metro network has plans for five more lines to be built, giving a total of 483km. Currently the city has 215km of lines, and Line 12 will bring that up to 240km. These lines are needed, but so is the budget to build them. There is also the 62-km wastewater Tunel Emisor del Oriente (TEO), rock tunnels of about 14m x 14m for La Yesca hydroelectric dam and several highway tunnels.

One project under construction is the modernisation of the Durango-Mazatlan highway crossing the Sierra Madre Occidental mountain range, which currently includes a more treacherous passage nicknamed the Devil’s Backbone. Around 60 tunnels in varying lengths are included in plans for the new highway and upon completion (expected in 2012) it will reduce journeys by up to three hours and be much safer.

Early this summer, Spanish tunneling contractor Proacon signed a contract for more than 200M pesos (USD 16M) from the Mexican Federal Government’s Ministry of Communications and Transport for six new tunnels, in addition to 14 tunnels already in progress by Proacon on the project. In total, the six tunnels measure 2053m long, the shortest of which is 123m, and the longest 710m. They have a common section of 110m2 and 130m2 of excavation. The contract also included single-bore Baluarte Tunnel, notable for accommodating four lanes of traffic and located in front of Baluarte Bridge. This also under construction as part of the project and will be the longest in Latin America.

Around the region there was a hesitation to see what would happen with the crisis, says Andrei Olivares, project engineer for Robbins Mexico. “But tunnelling is emerging again,” he says. “There is activity in Colombia, Argentina has some projects, and there is a metro line in the Dominican Republic.”

Cities across the region are planning, tendering and or executing metro projects, including Caracas in Venezuela, Santiago in Chile and both Sao Paulo and Rio de Janeiro of Brazil. The later, besides the increasing transportation demands day-to-day, is set to host both the 2014 World Cup and the 2016 Summer Olympics, putting further pressure on both cities. Elsewhere these projects include extensions, entirely new lines or even new networks as some governments have only begun building subway infrastructure.

The Dominican Republic’s government transport authority, called Opret by its Spanish acronym, has a master plan for phased construction of the capital city Santo Domingo’s metro system. Line 1 started commercial operations in January 2009, with the service running north and south. A Dosco Mk3A roadheader was delivered to the project this April to work on Line 2, which will run east to west across the city under John F. Kennedy Avenue, entirely underground. There are plans for Line 3, but a timeline has not been confirmed.

Panama City is currently in the bidding process for the design, build, equipping and commissioning of its first subway line. An announcement is due at the end of October to see which of two final bids will be awarded the 14km Line 1. Consortium Linea Uno (lead by Construtora Norberto Odebrecht (CNO)) and Grupo Italiano Metro Panama (lead by Impregilo) were the only two submitted bids for the 31 August deadline. A second line is being studied by the government.

That’s not all for country with a population of nearly 3.4 million. Elsewhere, CNO is constructing the 8km interceptor tunnel for the Panama City Wastewater Treatment Plant using a Herrenknecht EPB shield with a 3.67m diameter. The machine was delivered in August and started boring in early October. Funding for the project comes from the Inter-American Development Bank in the form of a USD-45M loan to the Panamanian Ministry of Health.

Next year, Panama will also see two very similar EPB TBMs launched on sister drives through lahar, a variable volcanic rock. The projects are on the Chiriqui Viejo River, close to the border with Costa Rica. Each machine will be used to construct a headrace tunnel, one of 7878m for the Monte Lirio hydropower plant and the other, just up stream, of 5161m for the Pando plant. Seli was awarded a USD-105M engineering-procurement-construction (EPC) contract for the two tunnels by Electron Investment, and it will undertake the work through a subsidiary, Seli Panama, which it established in November last year.

As T&TI went to press, opening ceremonies were held for hydropower stations in Chile (La Higuera and La Confluencia) while the Chacayes hydropower project is being constructed in adjacent Cachapoal Valley for 2011.

Originally a consortium of Astaldi and Fe Grande was awarded an EPC contract worth USD 282M in October 2008 for the Chacayes project, which includes 6km of tunnels. This was consolidated to 27.3 per cent in jv with Pacific Hyrdo in May 2009.

The capital city, Santiago, has also seen tunnelling for other transport. The San Cristobal 1.8-km, twin-tube road tunnel is part of a larger 4-km construction project connecting two districts in the east of the city to two others in the north through the San Cristobal Hill. Construction started in May 2006 using drill and blast. The toll road opened in 2008, though with restricted services. Germany’s Hochtief and Spain’s ACS Dragados have a 50-50 share in the build, operate, transfer project until 2037.

The 10.2m Robbins EPB TBM will spearhead the Mexico City tunneling San Cristobal is a twin-tube tunnel in Santiago by Hochief and ACS Dragados