Ask tunnellers and geological or geotechnical experts about how thinking on spending for site investigation (SI) has developed over recent decades and it is clear that, for the most part, the approach to identifying ground risk has moved on significantly. The argument to seek a sliver (even up to 5 per cent was uncommon) of a construction budget has given way to a more targeted approach, where SI is framed within risk assessment (RA) and supported by ever more knowledge shared of geological experience of strata.

The outcome of the RA approach is a technically justified, but never exhaustive, tactical tally of data and information that should be more than enough to answer questions about ground risk. The approach should deliver up a “cost effective” SI spend – a budget that has been developed rather than debated.

Project teams always face site-specific challenges. The ground on any site cannot ever be completely known, even after excavation of a tunnel alignment. The aim of the SI spend, therefore, is to get sufficient knowledge of ground conditions to hone the design and construction enough to judge an underground concept able to be safely, economically, financially and efficiently – and profitably, ideally – developed with, and not for, a client.

SHIFT IN APPROACH TO SI

David Fawcett, an international tunnelling consultant and past president of the British Tunnelling Society, tells Tunnels and Tunnelling: “Site investigation was difficult to sell in the ‘70s and probably into the ‘80s. Clients were reluctant to spend up front and rules of thumb were used to persuade clients of the sense of spending from 2 per cent to 5 per cent of the anticipated construction cost.”

The transition from budget pleading to a more efficient, risk-sensitive development of SI spend today was not a foregone conclusion, but gained impetus from various factors, including ground problems on some projects that got the financial community and insurers more involved. (See box, page 12).

The change in approach also has had support from a combination of factors, observes Fawcett, such as: accumulation and useful holding of more data generated from projects; the increase in information sharing (“internet very important here,” he says), despite the site-specific nature of project challenges; advances in excavation technology; and, not least, the bigger say of the financial community and insurers in project development, if clients want funding and coverage.

“In my experience, tunnel projects in particular have changed from being a risky gamble with the ground to being low risk,” says Fawcett. “This sea change is partly due to more versatile tunnelling equipment and partly due to a much better understanding of ground conditions.”

KNOWLEDGE

Not considering the old rules of thumb percentages in use any more, Fawcett says the approach to SI has shifted to “where available knowledge is utilised to target learning about potential risks so that they can be managed in advance and time and cost predictions become quite accurate.”

Fawcett adds: “Anticipated driving conditions are much better defined and tunnelling equipment is much more versatile.” The better time and cost accuracy comes, he says, from: more knowledge from experience working in particular strata; greater sharing and availability of such knowledge in the internet era; SI techniques being more sophisticated and focused on ground risks; and, lessons learned over the last 30 years having improved interpretation techniques.

The point on information sharing is agreed by Eivind Grøv, the chief scientist with a tunnelling focus at Norway’s research body SINTEF, an Adjunct Professor at the Norwegian University of Science and Technology (NTNU), and one of the country’s key figures in the underground sector.

Grøv says: “Improved sharing of information would lead to more cost effective SI.” And, hopefully lessons are not forgotten when a team disbands and individual move to the next project, coming together as new multi-disciplinary groups.

The development of plans for the Crossrail project, in London, over some years saw a gradual accumulation of the geological and geotechnical information from desk gathering of data to ongoing refinement of the SI works, Mike Black, geotechnical manager with the client has said. The project was able to draw on information from other projects as well as that held by the British Geological Survey (BGS). Part of its legacy is putting extensive information back into the BGS system, informing the “toolbox of options” for future projects.

PROCUREMENT

There are also progressions in procurement that concentrate the mind anew and revitalise discussions and activities around planning – and who ultimately pays – for ground risk. These include efforts at partial risk transfer from the client (though not necessarily cost transfer, ultimately) on procurement taking the like of design-build or public-private partnership (PPP) routes. As an underwriter told the Geological Society, in 2012, contractors don’t accept risk – they price risk.

Other approaches can see valuable insights brought to planning through early contractor involvement, and also uncovering various sensitivities and establishing limits and needs by liaison with third party stakeholders, especially in zones of expensive urban real estate, like London.

But procurement and contract form should also be strategically considered in light of the geological uncertainties, a recommendation given by professor emeritus Håkan Stille when giving the Sir Muir Wood Lecture 2017, Geological Uncertainties in Tunnelling: Risk Assessment and Quality Assurance, earlier this year at WTC 2017, in Norway. Stille says, “Many claims and construction mistakes have their roots in the fact that the contract and organisation have not been adapted to prevailing geological uncertainties.”

Last year, Pål Drevland Jakobsen of NTNU, in his presentation Geological and Geotechnical Investigations for TBM Projects to the TBM Application II conference, in Norway, observed that pre-investigation is “highly dependent” on various factors, including the “selection of contract type.”

The ITA, which says in Strategy for Site Investigation of Tunnelling Projects, 2015, recommends it be the case that each client “retains the final responsibility for the ground conditions, irrespective of the contractual framework that is chosen for the project.”

CLIENT EXPERIENCE

Fawcett says: “I believe it is now accepted by clients that significant money being spent on SI is necessary to manage project risk.”

However, even with RA-first approach, and with some recent ST spend data showing the up-to-5% ratio sits square in the data field of data obtained by Jakobsen (see box, page 10), questions on spending can come from some quarters, such as recently experienced by a UK contractor, Tunnels and Tunnelling was told.

Perhaps some may be less experienced clients, questioning the bang for bucks or how a cap can be put on SI spend.

Basically, why pay for more? Such questions would be less expected from seasoned clients, perhaps.

Grøv says owners might be, in a simplified way, split into two types – those who are multiple tunnel project owners and others with only a few or even one underground asset to develop. “They have, in my view, a significant different approach when it comes to SI,” he says.

Grøv says multiple owners often have their own approach to SI, the content and comprehensiveness based on their own experiences, and taking into account the likes of Eurocode 7. In Norway, as briefed in The Principles of Norwegian

Tunnelling, 2017, published for the Norwegian Tunnelling Society (NFF) when hosting WTC 2017, the national road authority (NPRA) phases its SI programme to match its four stages of planning and designing for tunnels, tightening cost estimates through the steps while noting more may be needed for tenders. “For the one-time owners, the approach to me seems to be a little bit different,” says Grøv.

While they may not necessarily have the same regulations to follow, they often have to attract overseas investors to secure project funding. His recommendation, then, is to apply the guidelines of ITIG to demonstrate the project, and its approach to SI, is adhering to international norms (see box, page 12).

Like many in the tunnelling industry, though, he also finds International Tunnelling Association’s (ITA) 25 Recommendations on Contractual Sharing of Risks, 1988, a useful touchstone. Grøv says: “Predictability is a key issue, particularly in those projects which are financed by funders and not governments.”

At the end of the day, however, it all filters back to the client – the owner being the party with the ultimate risk, he adds.

A huge project in its early stages of construction, and where the client is taking the ground risk, is the Lyon-Turin Base Tunnel between France and Italy. RISK: A FRAMEWORK FOR DISCUSSIONS

RA is integral to the strategy of project risk management that clients and funders and insurers increasingly understand and deliberate over. Therefore, the SI question should not sit in strained isolation. Risk management, therefore, gives the framework for discussions about everything, including SI.

The parties can heed the advocacy of the ITA, in Strategy for Site Investigation of Tunnelling Projects, 2015, saying: “Geology affects every major decision to be made in designing and constructing a tunnel.” But its report then cautions, “it is not possible to predefine the ground conditions in detail,” and therefore “geological risks exist on any tunnelling project.” Highlighting the strategic value of risk management (ways to mitigate and management hazards identified through RA), the report says the “purpose” of SI is to get “adequate and reliable” information, and early, to help sift the design and construction options and so “better cope” with the “identified potential risks.” Grøv says: “If SI does not provide additional value or reduce risk, then it is not worth doing.”

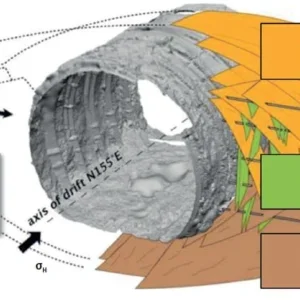

In his Muir Wood Lecture, Stille said: ‘The full knowledge of the actual geological conditions will first be revealed after excavation and even not then. This implies that the final design cannot be established in advance.’

Fawcett emphasises that this point made by Stille is very important.

GROUPING RISKS

On risk in rock engineering, Stille notes arguments against the use of risk matrices due to matters of objectivity and definitiveness. However, in observing the widespread use of the system, and its value as a communication tool, he comes to the view that “carefully used I believe it has its place.”

Stille advocates avoiding a mass grouping of all risks in a large single matrix or register, and instead to separate and group them into categories based on engineering issues – and he considers that rock engineering issues emerging from geological uncertainties should be so grouped.

‘This will have a good overview of the risks related to geology (geotechnical risks),’ he says.

Citing a variety of headline hazards (contractual, design, organisation, geological, technology, environmental, human and political), he notes they are not mutually exclusive and in many cases emanate from geological uncertainties.

But he emphasises there are many successful projects, and they are characterised by: clear objectives; experienced, knowledgeable and competent personnel; comprehensive view of risk; adequate management and information systems (including field monitoring); and, quality assurance (do the right thing, and properly). Having a geotechnical team on site is also necessary, he adds.

Stille further notes, to support those efforts, the value of Geotechnical Baseline Reports (GBR) to give “transparent communication of the geotechnical uncertainties,” and separately that ground characterisation should be split in line with design and construction considerations, respectively – unless its general characterisation then it must cover both. In a perspective on risk management, Fawcett says is nothing new, “it was always the constant tool of the professional.” With more documentation these days, however, more stakeholders are able to be briefed on the insights of the experienced tunnelling professionals. However, he cautions that highlighted risks need to be mitigated and not only documented.

ICELAND

In Iceland, where geology presents varied challenges, Bjorn Hardarson of consultant Geotek and who provides site supervision services to clients on many projects, tells Tunnels and Tunnelling: “It is a never ending debate how much you should spend on investigations.’

Hardarson says the main parts of SI are “rather similar” for typical road projects but depends on tunnel length, location, landscape, etc. The SI typical involves a general surface geological survey, some geophysical measurements and usually core drilling as the most expensive part. Our biggest concerns are the potential inflow of water (hot or cold), the volume of weak sedimentary layers and weak fault zones,” he adds.

The most recent project and the one that called for most core drilling – 1,660m, in total – is Vadlaheidi road tunnel which is also Iceland’s longest, at 7.2km. But the excavation only recent finished, having been delayed by unexpected and extreme geological and hydrogeological events – both hot and cold water, the latter at a collapse and flood behind the face.

Quantity is not always the solution to reduce risks,” observes Hardarson, in terms of pre-construction SI. He adds there is a tendency at present to increase investigation during excavation, such as routine probing.

Commenting generally on ground investigations during excavations, Grøv says “probe drilling ahead of the tunnel face” has been an important trend that is a change “to the better.” It particularly helps in performing geological and geotechnical mapping, allowing for continuous evaluation and, therefore, informing any modification needed to the geological model.

VALUE OF EXPERIENCE

Whatever the path to the start of excavation, out there waits the ground, barely seen and mostly untouched. The challenge of seeking more detailed insights will continue with each step in tunnelling and with probing ahead and around the face, until the end.

That the ground cannot be fully known may be a gripe for the beancounters and spreadsheet meisters. However, the challenge of excavating every foot and metre grips fast and tight in the minds of seasoned, long-term tunnellers and geologists, and the younger ranks rising up. Sometimes the problems can only get solved at the face. As Stille says in the tag to the title of his Muir Wood paper, “There is no substitute for experience.”

The value of experience was underlined in early September by Dr Chris Menkiti of Geotechnical Consulting Group, answering the Q&A when speaking on Tunnelling Ground Risks – A Client’s Perspective to the Engineering Group of The Geological Society, in London. He had discussed project successes, such as Crossrail, but also challenges met by two projects in Poland and Turkey, respectively.

Tenacity and experience will see challenges through, sooner or later, but getting a project started also demands insights and resources from client and financial experts. The sides are interwoven as will be their discussions around resolving risk through SI.