Funders of major Economic Infrastructure projects, both public and private, are increasingly questioning budget estimates – not only the sums involved but also the methods used to estimate them. Benchmarking potential projects against UK and overseas comparators is frequently carried out, but with mixed success.

In December 2010 Infrastructure UK (IUK), a department of Her Majesty’s Treasury, published the Infrastructure Cost Review (Technical Report)1 alongside its sister Infrastructure Cost Review (Main Report).

The review sought to investigate an apparent difference between the cost of infrastructure construction in the UK and other comparable countries.

Owing to an expected increasing workload of tunnelled projects at the time, one of the important cost comparisons was of tunnel works. The British Tunnelling Society researched the cost of a number of recently completed tunnels and produced a benchmarking appendix (Appendix G) to the 2010 Review.

This work has been referenced on a number of projects since 2010 and as tunnels are very much a part of the UK’s infrastructure plans for the future it was considered that an update of that appendix would be helpful.

This paper describes the background to a recent rebenchmarking of UK projects undertaken by the Infrastructure Projects Authority (the successor to IUK), the methodology adopted, the results, and recommendations for their use in future benchmarking exercises.

Infrastructure and Projects authority

The Infrastructure and Projects Authority (IPA) is the government’s centre of expertise for infrastructure and major projects. It supports the continuous improvement and successful delivery of all types of infrastructure, working with government and industry to ensure projects are delivered efficiently and effectively. It was established in 2016 from the merger of the Major Projects Authority and IUK, which produced the 2010 Cost Review mentioned above.

Infrastructure is one of five foundations of productivity set out in the government’s Industrial Strategy, along with Ideas, People, Business Environment and Places. Transforming Infrastructure Performance (TIP), published in December 2017, is the government’s plan to increase the effectiveness of investment in infrastructure, with ‘benchmarking for better performance’ constituting the first section of that plan.

To support this work, IPA has established a central benchmarking function which will support delivery teams and HM Treasury by encouraging better benchmarking across infrastructure.

Over the next 10 years, their ambition is to ensure that all major projects and programmes are selected and prioritised using benchmarked data on costs and performance.

Benchmarking

The term “benchmarking” has several meanings and frequently refers to the act of comparing an organisation’s performance or practices against others in that particular industry, with the intention of improving relevant metrics in one’s own business. Benchmarking uses data to challenge conservative or optimistic estimates, as well as setting and checking performance and cost targets. Appropriately used, benchmarking will drive competition and innovation, securing better financial outcomes for projects.

Whilst benchmarking has other applications beyond cost estimates, in this paper we use “benchmarking”, or more accurately “cost benchmarking” to mean the collation of actual costs from completed projects in order to predict likely outturn costs for a particular future project.

The process involves obtaining cost and performance figures for similar projects, which are then plotted against key influencing factors: for example tunnelling costs are often plotted against tunnel diameter or length.

Costs are usually expressed as all-in figures which are quick to use, for example cost per metre of tunnel. The figures are likely to need adjusting for inflation in order to fix a common date for comparison purposes.

UK Tunnelling cost and Production rate benchmarking

Working with the IPA’s TIP programme, a number of infrastructure organisations began compiling their own tunnel benchmarking data.

The IPA’s benchmarking team, together with Highways England (HE), sought to bring these data together in collaboration with the following participating organisations: Crossrail 2; High Speed 2 (HS2); Thames Tideway Tunnel; National Grid and Southern Water.

The work was carried out with the British Tunnelling Society (BTS) as subject matter experts and the author of Appendix G, to help collate the new data and prepare an updated cost benchmark for tunnels.

Logistics

The benchmarking initiative comprised a workshop with all interested parties to agree the process and necessary protocols, followed by the sharing of tunnel cost data and then a final meeting to receive the results.

In order to share information in a consistent manner a template was produced by BTS based on the International Construction Measurement Standards (ICMS). This was circulated to all participants for review prior to the workshop.

A non-disclosure agreement was also drafted and duly signed, and methods of anonymising, encrypting and storing data were discussed and agreed.

Practical difficulties of Benchmarking Tunnels

When attempting to benchmark major economic infrastructure (such as rail, road, energy or water projects), difficulties have been encountered.

- There is often an insufficient number of similar projects or of similar tasks to enable reliable unit costs to be established.

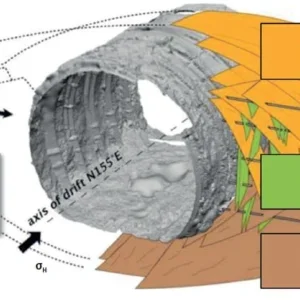

- For tunnelling projects there are a number of variables, such as ground conditions, tunnelling method, length, diameter, access arrangements, the number of shafts and cross passages, which make any direct comparison difficult or impossible.

- Owing to the long duration of infrastructure projects the costs available at completion are usually a number of years out of date, compounded by the fact that the project may have been tendered or started in very different economic conditions to those prevailing when the benchmarking exercise is carried out.

- Given the cost data for completed projects it is often not possible to separate the costs related to tunnelling from other costs. The contract sum may or may not have included items such as indirect (for example, overhead) costs, spoil disposal, cross passages and portal construction. Industry experience suggests that projects in other western European countries tend not to include the costs of supervision or land purchase, for example, tending to make projects appear relatively cheap when compared with UK projects in which those costs are usually included in the overall figures.

The lesson drawn from the difficulties given above is that benchmarking cannot be undertaken as a purely mechanical exercise – subject matter expertise is required to enable sensible decisions about which projects are valid benchmarks, how to adjust for inflation and economic factors, and also how to allow for differences between the benchmark projects and the project in hand.

Benchmarking approach

The Infrastructure and Projects Authority’s benchmarking methodology, formulated with support from the private sector and based on the HS2 methodology developed in 2016, seeks to challenge bottom-up cost and time estimates by breaking down the total project cost into various components which might in themselves be common to other projects, to produce a Benchmark Indicative Asset Cost (BIAC).

For this activity, data was collected directly from a range of departments, sponsors, programmes and other controlled sources involved in tunnelling activities.

The data collected was mainly of historical cost, schedule, performance and project attributes.

A standardised template designed by the BTS was used for data collection, and the data was transformed before being analysed. Firstly the total cost for each tunnel was rebased to 2016/2017 using the GDP deflator; and secondly sample statistics were obtained and analysed to assess the quality of the sample and the validity of the inference made from the sample.

Results

Data were obtained for 16 UK tunnels from both the transport and utilities sectors, in ground conditions ranging from soft rock to cohesive and noncohesive soils.

Construction methods included TBM, backhoe shield and excavator, with precast concrete or shotcrete linings.

Four of the 16 tunnels were also included in the 14 UK tunnels included in the 2010 Cost Review database. In order to avoid duplication in this paper these tunnels have been included in the 2017 dataset, to ensure that a comparable methodology has been deployed, and excluded from the 2010 data set.

The two graphs used in the 2010 Cost Review were unit cost (GBP millions per kilometre) versus outside diameter (m), and unit cost versus tunnel length.

Figure 1 shows the 2010 and the 2017 unit costs plotted against outside Diameter

It can be seen that there is a good correlation between the 2010 and the 2017 data, suggesting that costs of tunnelling have changed little in real terms over the seven-year period.

It can also be seen that there are two outliers in the 2017 data. These are both large diameter rock tunnels and they, together with the only other rock tunnel (of smaller diameter), have been removed from subsequent analyses.

Benchmarking of rock tunnels in the UK would be reliant on this small number of projects and it is recommended that these data are used with caution and by subject matter experts.

Soft Ground Tunnels

Removing the rock tunnels, see Figure 2 for soft ground tunnels.

It can be seen that the expected trend of increased unit costs for increased diameter, noted in the 2010 Cost Review, remains.

There is, as expected, a considerable scatter in the data on the graph, so a trend line can only be tentative.

The trend lines shown have been obtained using the “power” function in Excel and appear to the authors as being more appropriate than a straight line (or any of the more complex mathematical functions).

The trendlines for 2010 and 2017 on Figure 2 are remarkably close, supporting the view that costs have remained static in real terms over the period 2010 to 2017.

The data fall broadly into three sets: (i) a closely spaced group of tunnels between 2.5 and 4.5m OD, (ii) a more widely-spaced group of tunnels in the 5m to 8.5m OD range, and (iii) two tunnels greater than 10m OD.

These three sets have been plotted separately on Figure 3, together with trend lines for sets (i) and (ii).

The tunnels between 2.5 and 4.5m are exclusively utility tunnels and their unit cost appears to be around GBP 8-15M per kilometre, unless shorter than 1 or 2km.

The two transport tunnels over 10m diameter are of similar length and similar unit cost, around 30m to GBP 30-35M per kilometre.

The unit costs of the predominantly transport tunnels between 5m and 8.5m are dependent on length and it is considered that the power function trendline provides a reasonable first estimate for an average benchmarking figure. It is proposed that this graph be used as a starting point for benchmarking the costs of future soft ground tunnels in the UK.

Tunnel purpose

It had been thought that the cost of tunnels depended to an extent on the purpose of the tunnel, with a difference between transport tunnels and utility tunnels. The data do show that utility tunnels generally have a lower unit cost but are also, on average, smaller diameter than transport tunnels. It is considered that it is this difference in size that largely explains the unit cost difference.

Nevertheless, there are other factors that could result in utility tunnels having higher unit costs than transport tunnels, such as a relatively low contract value, with ensuing proportionally higher fixed costs such as TBM purchase and site establishment, and such differences should be considered when benchmarking tunnels of different end uses.

Performance (Tunnel Production rates)

Production rate information was available for six utility tunnels and five transport tunnels. Figure 4 shows the weekly average production rates and the daily and weekly maximum production rates for all tunnels. There is a considerable scatter of the results, but there is an expected trend for the production rate to fall with increasing diameter (and hence excavated volume).

The trendlines have again been derived using a power function in Excel. The monthly maximum production rates were, on average, 17 times (range 15-22) the daily maximum. The mean of the weekly averages was just over twice the daily maximum rate.

Tunnelling typically has a low production rate at start-up as the production cycle is established and the project teams become familiar with the machinery and ground conditions.

This difference in productivity can be large, and caution and expertise are therefore required when making early stage assessments of programme durations of tunnelling projects.

Summary

The costs of tunnelling for UK infrastructure projects were first benchmarked in the IUK Cost Review 2010. Since then the benchmark figures have been used to establish cost estimates for a number of subsequent UK infrastructure projects.

In 2018 the Benchmarking Team of IPA brought together a number of infrastructure client organisations to share cost and performance information, to update the tunnelling benchmarking graphs. Cost and performance information from sixteen projects was collected and analysed. The data are presented on graphs in the body of this paper and suggestions made for their use in benchmarking.

The good correlation between the 2010 and the 2017 data shows that costs of tunnelling have changed little in real terms over the seven-year period.

There are very little data for benchmarking of rock tunnels in the UK. It is therefore recommended that the rock tunnel data available are used with caution and by subject matter experts.

The unit costs of the (mainly utility) tunnels between 2.5 and 4.5m in diameter appear to be around GBP 8-15M per kilometre, unless shorter than 1 or 2km.

The unit costs of the (predominantly transport) tunnels between 5m and 8.5m OD are dependent on length. The trendline proposed as a reasonable first estimate varies from GBP 35M/km for short (2km) tunnels to GBP 15-20M per kilometre for tunnels over 10km.

The two transport tunnels over 10m diameter are of similar length and unit costs, around GBP 30-33M per kilometre.

Tunnelling is a complex activity and no two tunnels are the same. Consequently, there is a considerable scatter in the available data and it is strongly advised that, when these graphs are consulted for benchmarking future tunnel projects, they be used intelligently and by subject matter experts.