TUNNELLING IN AUSTRALIA was given a real boost in 1997 when the Warren Centre published its Study on Underground Space.

The thought leadership organisation outlined the benefits of the greater use of underground space for transport, utilities, warehouses, and even sports facilities. It also detailed the necessary planning, finance and geotechnical considerations, as well as the need for more research and development to improve the technology.

According to Malcolm Dixon, GHD’s principal engineer – tunnelling, over the past five to 10 years there has been a steadier stream of major projects as the popularity and awareness of possible underground solutions for urban areas has increased. Client organisations are far more aware of available tunnelling techniques to provide underground solutions on their projects," he says, adding that representatives of client organisations are often seen at international tunnel conferences.

Many international construction and design companies are looking to establish an Australian branch to their business and more young practitioners are interested in a career in tunnelling. "The Australasian Tunnelling Society (ATS) Tunnelling Short Course in Brisbane in 2015 demonstrates this growing interest among young professionals," says Dixon.

When James Garnier of CH2M moved from the UK to Australia 11 years ago the tunnelling industry was starting to take off and, fuelled largely by the booming mining industry, that progress continued for a decade. Now, however, with that investment phase completed tunnelling work has turned largely to transport schemes.

"We have a large projected population growth, centred around the main capitals. There’s also a push to link up the major areas of population," says Garnier.

There’s also a need to alleviate traffic congestion. The NSW government estimates that traffic congestion is currently costing Sydney AUD 6bn (USD 4.6bn) a year, a burden that is set to grow to AUD 28bn (USD 21.3bn) by 2031 unless solutions are found.

And providing and improving transport systems in densely populated urban areas means tunnelling is an obvious solution.

David Lees, Australasian Tunnelling Society editor, says this is good news for the tunnelling industry. "The future for tunnelling seems bright, particularly for large infrastructure projects as the government tries to get public transport working but still needs to reduce congestion of road traffic," he says, adding that trenchless technology for utilities is also busy.

Some of these projects are funded by the state or federal government while others are PPP or unsolicited proposals. Work is under way on Sydney’s metro and the Victorian government recently announced that the Melbourne metro will go ahead. There is also likely to be investment in separating passenger and freight networks to remove the latter from city centres to unlock capacity from passenger lines.

Another big rail project is an inland rail route linking Brisbane and Melbourne, via Sydney. It has been "discussed for years and years", says Garnier, and the federal government has just released AUD 300M (USD 228.9M) for a further study. There is still no schedule for the new line but Garnier is confident it will happen "perhaps in the next five or 10 years".

Despite the revolving door of prime ministers in recent years, the Australian government’s focus on infrastructure has remained consistent, according to Dixon, with significant federal funding devoted to road and rail freight projects. Now Prime Minister Malcolm Turnbull has indicated there may be greater federation involvement in public transport, which may also include tunnelling components.

Often, however, projects fall victim to the rough and tumble of Australian politics and the short political cycle. A change in state government can change the appetite for infrastructure or the approach to funding.

"Changes in government are always interesting because each one says that the previous government’s decisions were wrong," says Lees. "In Brisbane we have seen decisions going backward and forward between the Cross River Rail and the BAT Tunnel; in Melbourne decisions on the Melbourne Metro and eastwest link road tunnels have also changed with changing governments."

In Queensland, Labor, which replaced a Liberal government, has stopped the leasing of assets to fund infrastructure, while in New South Wales the Liberal government was re-elected on the back of a promise to do just that.

"They managed to get their message over well as to their plan for the future and the benefit to the population and how it’s going to be funded," says Garnier. The NSW government recently started the leasing of the electricity network, boosting the state’s coffers to provide the funding for infrastructure projects.

The Victorian government has a reputation for successful PPP projects but a recent change in government demonstrated projects’ vulnerability to political changes. When Labor came to power it stopped the east-west tunnelling link which had already been awarded to Lend Lease and Bougyues.

"It was quite a major tunnelling project and everything had been signed and the financing had been dealt with," Garnier explains.

Although the Sydney metro is starting, about six years ago a change of government led to the project in another guise being cancelled despite tenders having been submitted. This type of situation has created some caution in the tunnelling industry. "Construction consortia invest around AUD 20 to 30M (USD 15.3 to 22.9M) in tendering so there is always concern when a major project comes up near the end of a political cycle or there is significant resistance from one party or within the existing government," says Garnier. "It’s all down to the short political cycles where rather than getting stuff done, people worry about reelection."

The conservative approach of government clients also impacts on companies’ decision to tender. "One of the big gripes here is the cost of tendering and the sheer volume of documents that’s required to be analysed at the time of tender. That in itself tends to stifle a lot of new thought because there’s concern over who’s reviewing it," says Garnier. "It also pushes up the cost so people are less willing to come up with new ways of thinking because of the volume of documentation that goes with it and then it will be a noncompliant tender."

This means there can be a slower uptake of what might be established technology in Europe.

"One example is segmentally lined shafts which are standard use in Europe. No-one had done it in Australia until six or seven years ago and because of that it’s difficult to get it through the approvals process," says Garnier. There could be similar challenges ahead as plans for three-lane motorways will require larger TBMs. "Some of the technology that’s been used elsewhere to generate the size of those TBMs will be a new thing in Australia and we will have to bring the clients along on the journey," he says.

Dixon says Australia’s steady development of tunnelling over the past decade has already encouraged the use of some new technologies.

"We’ve seen the rapid adoption of international technologies like steel and synthetic fibre-reinforced concrete, precast construction, sprayed waterproof membranes and various types of TBMs," he says.

As clients’ understanding of tunnelling techniques and potential increases so too does their appetite for bigger and longer excavations, which can bring benefits for the client and project team.

"The fewer intermediate launch and retrieval points along a proposed tunnel represent significant stakeholder, interfacing and risk minimisation advantages," says Dixon.

However, he too warns that the high cost of tunneling projects is potentially a limiting factor.

"We need to ensure that we’re not gold plating our tunnels with systems and complexity that may not be required. There will be a continuing need for innovative tunnelling solutions to drive value for money for inner urban underground transport projects and maximise net benefits and productivity gains for the broader economy," he says.

The mining industry’s interest in civil engineering techniques is another trend in the Australian market. "In particular both Robbins and Atlas Copco have been working with the big mining companies to develop special equipment for underground excavation," says Lees, adding that a Robbins TBM has just completed the decline at Grosvenor Mine.

Dixon agrees that the Grosvenor Mine could be a marker for Australia’s tunnelling industry. "Pioneering projects like this demonstrate the potential for extending innovative tunnelling techniques into new industry sectors," he says.

Just as state politics can affect infrastructure projects, so too can interstate rivalry and the development of metro schemes in some of Australia’s largest cities has invigorated the historical competition between the east coast states. "We saw it with the desalination plants eight years ago where one started building one and all the others decided they wanted one too, so all the programmes overlapped. We’re starting to see that now with the major metros," says Garnier.

This flurry of activity means that, aside from what is already under way, three major tunnelling projects – the Sydney metro’s City and West section; Melbourne metro; and Melbourne’s Western Distributor road project – will all come to market around the third quarter this year.

"In terms of tendering that will soak up all the capacity in Australia," says Garnier.

Dixon agrees that there is potential for skilled labour shortages but says that both Australia and New Zealand have significant home-grown skills and experience in designing and delivering tunnelling projects of all sizes.

"We also anticipate continued interest from international companies looking to take part in local projects. The growing influence of Chinese construction contractors and design institutes is also a key factor," he says.

Transport dominance

There are now many rail or road schemes on the drawing board or under way in Australia, many of them vying for the title of the country’s largest transport infrastructure project.

In March last year, the first sod was turned on WestConnex, a three-stage motorway project to expand capacity and improve traffic flows on the existing M4 and M5 roads – the latter considered to be the worst motorway traffic bottleneck in Sydney – and improve links to the city’s airport and the Port Botany area. In order to keep property purchases and disruption to a minimum two-thirds of the scheme – around 22km – will be tunnels.

Stage one involves widening the M4 and extending it via the 5.5km M4 East twin tunnels (cut and cover); stage two is a new M5 running from the existing M5 East corridor at Beverly Hills via twin tunnels to St Peters, more than doubling capacity of the corridor and substantially improving east to west corridor access between the Sydney CBD, Port Botany and Sydney Airport precincts and the south-west growth areas; and stage three will join the first two stages with 5.5km twin tunnels with three lanes in each direction.

Leighton Contractors has been selected to design and construct stages one and two. For the AUD 2.7bn (USD 2.1bn) stage one contract the company is in a joint venture with John Holland and Samsung C&T, and for the AUD 4.3bn (USD 3.3bn) stage two it has teamed up with Dragados and Samsung C&T.

Stages one and two are due to open in 2019 and the final stage is scheduled to open to traffic in 2023.

In the north of Sydney, work has also started on the 9km NorthConnex motorway tunnel. The AUD 3bn (USD 2.3bn) toll road will alleviate traffic on Pennant Hills Road, said to be Australia’s most congested urban road, by linking the M1 Pacific motorway at Wahroonga to the Hills M2 at West Pennant Hills via twin tunnels. When complete in 2019 it will link Sydney’s north to the orbital network and enable the 1,000km journey from Newcastle, north of Sydney, to Melbourne to be made without encountering a single set of traffic lights. Excavation of the first tunnel shaft started last September. Tunnel shafts will be excavated to a depth of up to 93m, providing the launch point for roadheaders to tunnel to the north and south.

The tunnels in both North and WestConnex will have complex interchanges with the existing motorway, says Lees.

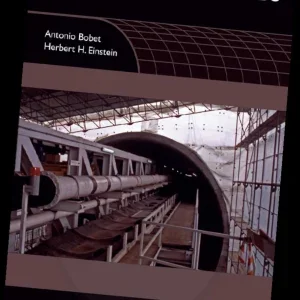

In January tunnelling was completed on the AUD 8.5bn (USD 6.5bn) Sydney Metro Northwest, Australia’s first fully automated metro rail system and the first stage of Sydney Metro.

This first route will deliver a fast public transport system to Sydney’s north west, an area which has the highest car ownership levels per household in Australia and where the population is forecast to grow by 200,000 over the coming decades. Stretching west from Epping to Bella Vista, the new line comprises twin 15km tunnels – Australia’s longest rail tunnels – with connecting cross passages about every 240m.

The contract has also notched up another milestone as the first transport infrastructure project in Australia to use four TBMs. Each 120m-long machine has a diameter of 7m and the finished tunnels will be 6m in diameter.

Roadheader machines are being used to build the short sections linking the new tunnels to existing tunnels, as well as the cavern to allow trains to cross from one track to another. The Thiess John Holland Dragados joint venture is carrying out the AUD 1.15bn (USD 880M) tunnelling contract, which also includes the excavation and civil works for five new stations along the route.

On average, the tunnels are 29m deep, with the deepest point at 58m.

Sixty per cent of boring is through Sydney sandstone, and the rest shale. The 2.8 million tonnes of crushed rock excavated by the TBMs is being recycled on commercial, residential and environmental projects elsewhere in Sydney.

A factory established at Bella Vista has produced the 100,000 concrete segments for the 16,000 concrete rings that line the twin tunnels.

Services on Sydney Metro Northwest are scheduled to start in the first half of 2019, delivering a single-deck train every four minutes during peak hours. Under the next phase of Sydney’s Rail Future, the NSW government’s rail plan, the rapid transit network will be extended under the harbour and into the central business district.

In Sydney, ventilation can be a challenge for long tunnels, says Lees. "The M4 East will be heavily used by large trucks and there have been many concerns about the quality of air in the tunnel," he says.

A few years ago the NSW government built a filtering system, at large cost, for trial but concluded it didn’t assist in the tunnel ventilation. "Certainly every time a new tunnel is planned the biggest hurdle is over where the ventilation stacks will be located," says Lees.

In Brisbane the on-again-off-again cross-river project has been another casualty of political changes but it’s still on the state’s agenda and the Queensland government plans to make a funding submission to Infrastructure Australia and the federal government. The crossing was originally proposed as a bridge but subsequent revisions have included a twin-tunnel and a single tunnel concept.

In Perth steady progress is being made on the Forrestfield-Airport link and recently the Salini Impregilo – NRW joint venture was named as the preferred bidder for the main design and construct contract. When it opens in 2020, the AUD 2bn (USD 1.53bn) state government-funded train line will connect Forrestfield to the city, opening up Perth’s eastern suburbs to the rail network and improving connections to Perth Airport. The 8.5km route is largely underground, with two 8km tunnels which will be bored beneath the airport runway and the Swan River.

Last year geotechnical studies were completed, including the creation of 150 boreholes, 25 monitoring wells and five pumping test wells. Construction will start later this year. The area’s complex geology has led Perth Transport Authority to specify an EPB and slurry mixshield TBM. Generally Australia’s geology is quite straightforward for tunnelling, especially in Sydney which is built on sandstone.

"In Sydney there is great experience now in excavating tunnels in Sydney sandstone, both with TBMs and roadheaders," says Lees. "One tragedy on the Cross City Tunnel in 2004 where the roadheader operator was killed has enhanced our understanding and respect for the bedding in the Sydney sandstone."

Melbourne sits on a basalt cap but in some areas the Coode Island silt, an alluvial deposit of the Yarra River, has to be managed. "The moment you start dewatering it you get a massive amount of settlement," says Garnier. "In Melbourne any tunnel you put in generally interfaces with this silt at some point so you have to be careful with dewatering and the way you work with it, or any hydraulic operations."

Lessons were learnt, says Lees, during construction of the CityLink motorway network in the late 1990s. "The problems associated with Melbourne CityLink and the draining of the surface sediments causing settlement to some important buildings will certainly ensure that the permeability of the Melbourne mudstone will be taken well into consideration in future projects," he says